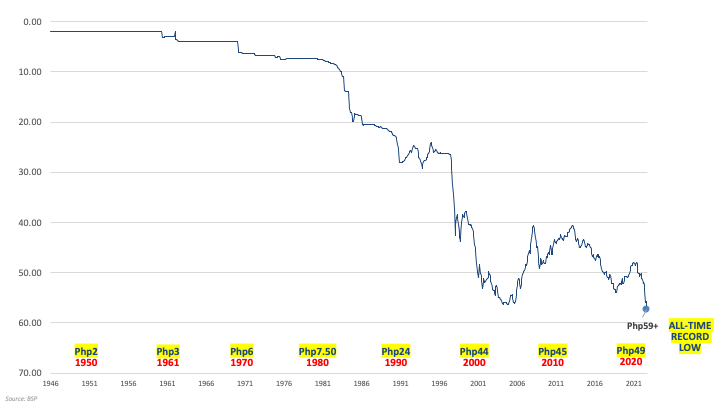

The Philippine peso has been hitting record low after record low. This will be among the main drivers of accelerating domestic inflation which will burden Filipinos with rising prices of basic needs on top of their floundering incomes and earnings.

The government says the peso’s fall is due to external factors. The United States (US) Federal Reserve is particularly blamed for its aggressive interest rate hikes since the start of the year. Saying that so many other currencies are also weakening against the dollar, the government basically wants to justify inaction – because the peso’s fall is like a natural calamity that we have no control over.

Freefalling peso

US interest hikes do make the US dollar stronger which is a major factor in the peso’s current depreciation. However, the administration’s calculated dismissiveness diverts from how there are deeper reasons for the peso falling to record lows; there’s an underlying structural reason why the peso has been falling for over 60 years now.

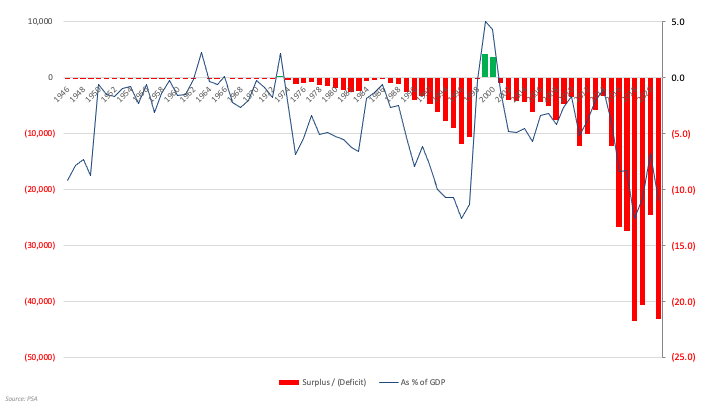

Philippine peso falling to record lows. Philippine Peso per US Dollar exchange rate, 1946-Sept 2022p (Php)

Putting the blame entirely on the US also diverts from how the Marcos Jr. administration is not completely helpless and can take more active measures to at least moderate the peso’s depreciation.

Forex dump

Before anything else – what does it mean to say that the dollar exchanges for so many pesos? The foreign exchange (forex) rate is basically the amount of one currency that you can exchange for another. For instance, US$1 now exchanges for Php59.

That is the familiar putting of the dollar in peso terms. We can go the other way though and put the peso in dollar terms – in which case we get the less familiar but still correct calculation that Php1 exchanges for around US$0.017.

When the peso is said to be “weakening” the technical term for what is happening is that the peso is depreciating or losing value. In effect, the peso is getting cheaper – for example from being US$0.021 in January 2021 to less than US$0.017 today. The opposite happening is an appreciation.

If the forex rate is basically the price of a currency, then what sets this price? The current forex regime in the country is a flexible exchange rate system. Under this set-up, the price of the peso is basically set by its supply and demand in the forex market. To put it a little simplistically, imagine a forex market with just pesos and dollars. If the demand for dollars relative to the peso increases, then the price of dollars rises and conversely the price of the peso falls.

Another forex regime that was common for a very long time is the fixed exchange rate regime. Under this set-up, the government sets the price of its currency and decides when to change it depending on forex market conditions. Here, an adjustment downward in a currency’s value is called a devaluation (instead of depreciation) while the opposite is a revaluation.

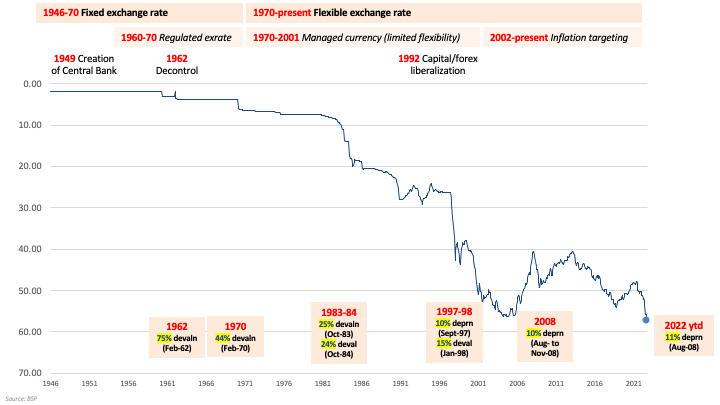

The Philippines had a fixed exchange rate regime until 1970 when it adopted the flexible exchange rate system which it has until today

Even after supposed Philippine independence, the US tied the exchange rate at Php2:US$1. There were strict currency controls. Only the Central Bank traded in foreign exchange and decided where to allocate these. By 1962, direct controls were lifted and the banking system was allowed to do currency trading albeit under strict Central Bank regulation. All foreign exchange earnings had to be surrendered.

The peso was floated in 1970 and allowed to be set by foreign exchange trading and market conditions. The Central Bank however still continued to manage the currency through the purchase and sale of foreign exchange and some capital account restrictions. Notably, the consecutive devaluations in 1983-1984 under International Monetary Fund (IMF) stabilization programs precipitated inflation reaching a record-high 49.8% in 1984. Currency management was liberalized further in 1992.

Foreign exchange earnings increased especially with growing overseas remittances. Pursuing policies supportive of neoliberalism, the Central Bank declared inflation targeting as its approach to monetarist policy in 2002. This also meant that it formally stopped setting targets for the exchange rate and – apart from possibly some smoothening – would just accept the exchange rate resulting from prevailing policy interest rates set according to inflation targets.

Show your depreciation

A country’s foreign exchange rate is a strange creature. It measures the demand for a currency but can actually also be a tool for influencing the demand for a currency. This is also why a depreciation or devaluation is not necessarily a sign of “weakness” and, in a different context, may even be consciously used by a government to boost exports.

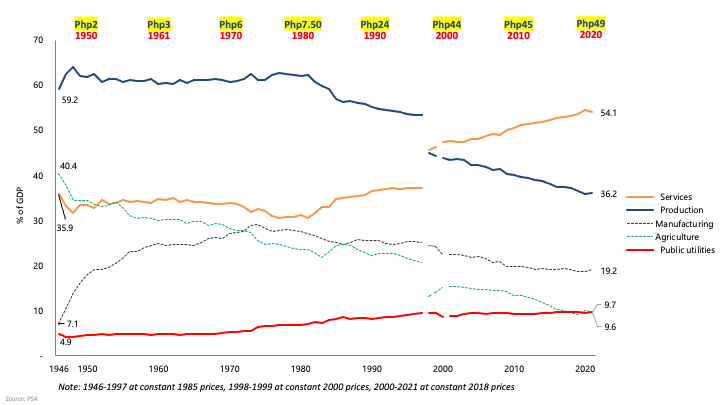

In the case of the peso though, it really is a sign of weakness. It is no coincidence that the peso’s decades-long freefall accelerated as the Philippines liberalized and weakened domestic agricultural and manufacturing production.

Peso depreciated as agricultural and domestic manufacturing weakened. Industry Share of GDP, 1946-2021 (%, at constant prices)

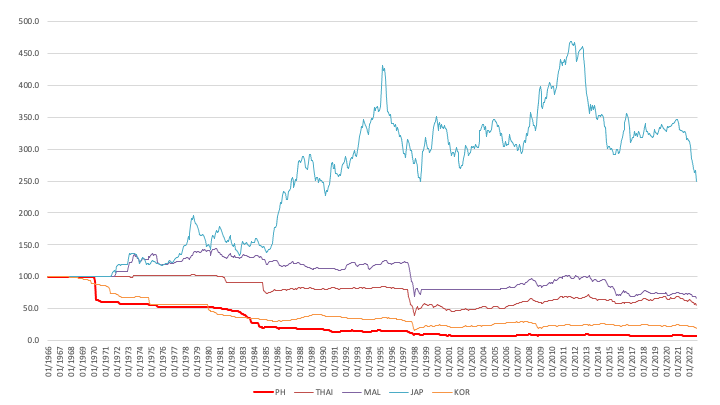

This is also the broader context in which to understand recent comparisons of the peso’s fall against other countries. The peso’s problem, we are told, is not exceptional because the currencies of other more developed countries like Japan and Korea are also falling.

Yet while this may be the case in the last few months, the picture is different taking a longer view.

Peso historically falling much more than Thai baht, Malaysian ringgit, Japanese yen, and Korean Won. Average USD per selected Asian currencies, 1966-present (1986=100, monthly)

From this perspective, the peso has clearly fallen much more than the Malaysian ringgit, Thai baht and Korean Won. The Japanese yen even strengthened.

These countries have also seen their domestic economic foundations improve by so much more than ours – even those who may have seen their currencies “weaken” in the past decades.

Trading down

The country’s import-dependence has been worsening since the dictator Marcos set the country on the path of neoliberal economic policies especially from the late 1970s. With manufacturing at its smallest share of the economy since the 1950s and agriculture at its smallest in the country’s history, the country is importing more and more of what it needs.

These imports are largely paid for in dollars, and what the constant peso depreciation is saying is that the country is not earning enough dollars to pay for these imports and other foreign transactions. The demand for foreign exchange is for imports but also to finance hot money or portfolio investment outflows, profit remittances of foreign corporations, overseas investments and spending of Filipinos, and external debt service.

Exports being less than imports is a big factor though and the country’s trade deficit is not just chronic but even worsening.

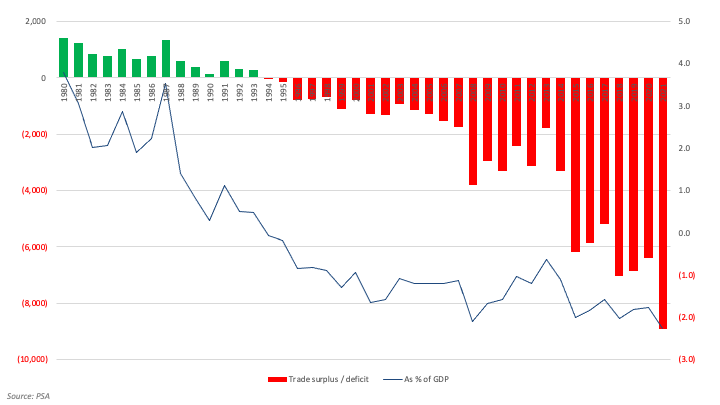

Trade deficits worsened in the era of neoliberalism, Trade surplus/deficit, 1946-2021 (US$ million, % of GDP)

Whether measured in absolute terms or as a share of gross domestic product (GDP), the country’s trade deficit has gravely worsened since the late 1970s. The US$43.1 billion deficit equivalent to 11% of GDP in 2021 is already the second worst in the country’s history.

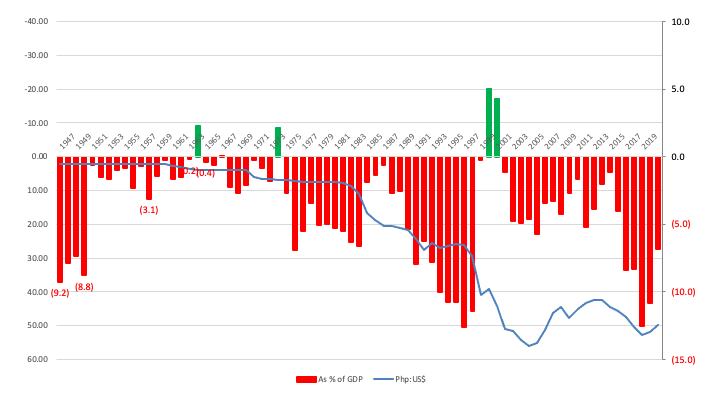

The peso’s depreciation is justified as improving exports by making what the country produces cheaper and implicitly improving our trade balance. This does not seem to be the case though and decades of the peso depreciating have just seen the trade deficit generally worsening.

Peso falls but trade deficits still grow. Trade deficit (as % of GDP) and Peso-Dollar exchange rate (Php:US$), 1946-2021

This is mainly because of underdeveloped agricultural and industrial production. The peso’s depreciation makes imports more expensive with unfortunately no substantial domestic export response because we are producing so little that the rest of the world would be interested in. The growing import bill offsets any supposed export gain.

As it is, agricultural, forestry and mineral products are down to less than 15% of exports. Although some 85% of reported exports are manufactured goods, these are mostly made by foreign manufacturers based in the Philippines that are themselves hugely import-dependent.

The country’s agricultural trade includes manufacturing raw materials like tobacco and wood, animal feeds, ornamental plants, and other non-food products. Still, the overwhelming majority of agricultural trade consists of food. The country’s growing food insufficiency is particularly striking.

Agricultural trade deficit at record high. Agricultural trade surplus/deficit, 1980-2021 (US$ million, % of GDP)

It means that we are producing or exporting less and thus importing more agricultural products. The agricultural trade deficit of US$8.9 billion deficit equivalent to 2.3% of GDP in 2021 is the biggest in the country’s history.

OFWs win?

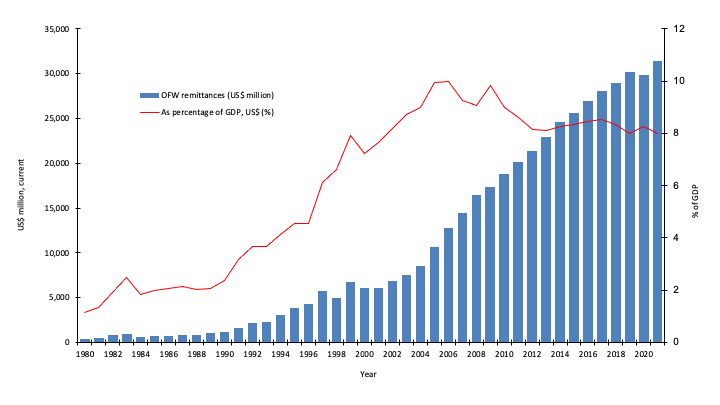

The peso’s fall would be even worse were it not for the country’s single biggest source of foreign exchange – overseas Filipino workers (OFWs). While overseas remittances continue to increase, the rate of growth has slowed and their equivalent share in GDP has actually been falling for over a decade now.

Overseas remittances still growing but weakening. Overseas Remittances, 1980-2021 (US$ million, % of GDP)

Another way that the peso depreciation is spun is that OFW families benefit. Yet though substantial, less than three out of five Filipino families (28%) get cash receipts from abroad and will gain from a stronger dollar vis-à-vis the peso (Family income and Expenditures Survey or FIES 2015). As it is, only 7.2% of total family income comes from abroad which is actually much smaller than 11.1% reported two decades ago in 2000 (FIES various years).

The average cash remittance of OFWs is even falling and is down to just Php12,963 monthly as of 2020 from Php13,683 the year before (Survey on Overseas Filipinos 2020). A large part of any foreign exchange gain that families receive will likely just be off-set by the rising prices of goods and services.

This is even aside from how the OFWs themselves are likely also struggling with rising prices wherever they are deployed to.

Taking control

What should be done? The most important long-term concern is to strengthen the economy’s fundamentals – develop domestic agriculture and build Filipino industry. This should lessen the demand for dollars to import so much of our needs, as well as increase the supply of dollars from selling genuinely Filipino world-class products.

That journey of a thousand miles can however begin with a single step today – moderating the peso’s fall to lessen the adverse impact on millions of distressed Filipino households. The pressure on the peso from growing demand for finite dollars can be lessened. Little can be done in the short-term in terms of reducing imports of essential food and fuel, even as there should already be investments in reducing this import-dependence.

More can be done by the government reining in its own demand for dollars. It can pull back on the so-called Build, Better, More (BBM) infrastructure projects that import so much of their materials, machinery, equipment and even contractors. It can also negotiate with foreign creditors to reschedule external debt service, especially international development agencies and governments seen as “partners, friends and allies”.

The government can also consider capital controls especially on the outflow of capital as successfully used, for instance, by Malaysia and Taiwan during the 1997 Asian Financial Crisis and notably by China and India even today. There can be targeted measures to slow short-term portfolio capital movements or perhaps even other external capital transactions. These can range from higher transaction taxes to more explicit restrictions. These will be easier to impose if the Philippines coordinates with other countries in similarly difficult circumstances.

There are no easy answers to the mounting difficulties the Philippine economy and the Filipino people are facing. Neoliberal or free market dogma is however a self-imposed constraint that the government can choose to relax in favor of a more pragmatic approach. The situation is so urgent that any and every justification for inaction should be critically examined.