Philippine economy

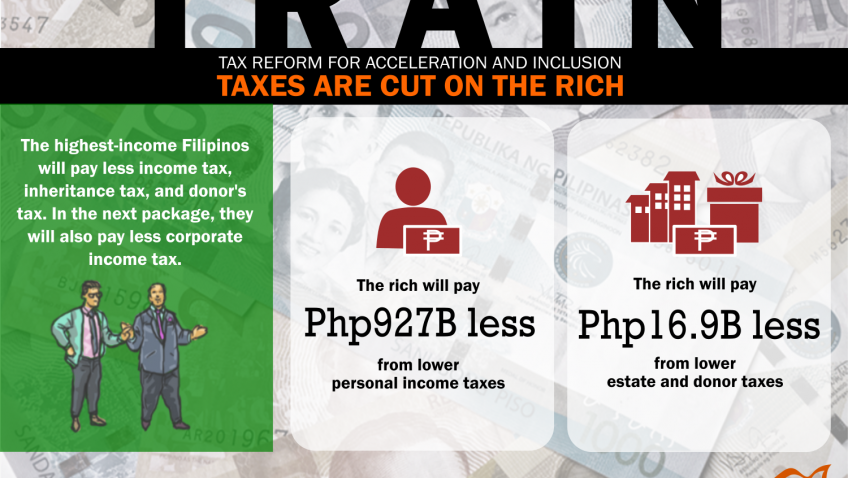

Under TRAIN, taxes are cut on the rich (TRAIN Infographic #5)

September 28, 2017

TRAIN will make the rich richer – The net impact of the change in income taxes, expansion of VAT coverage, new oil excise taxes, and inflationary effect is that the highest-earning 40% of Filipino households, or 9.1 million households with some 40 million Filipinos, will have more money in their pockets after the tax reform. This […]

Will the poor benefit from paying higher taxes?

September 25, 2017

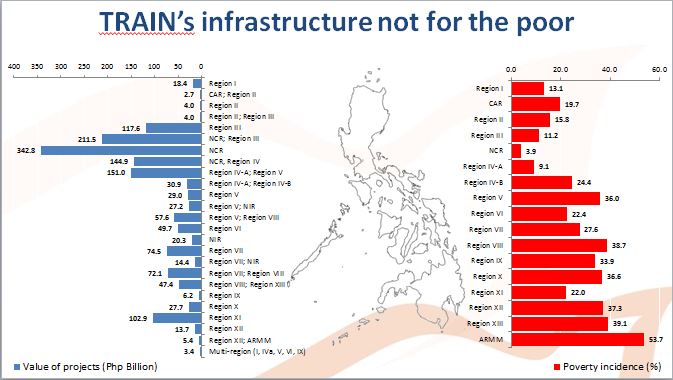

by Audrey de Jesus Among the hyped claims of the Department of Finance (DOF) about the government’s tax reform package is how taxes paid by the poor will go back to them in the form of infrastructure projects and social services. The reality however is that the taxes will go largely to big-ticket infrastructure projects […]

Real wage falling, higher taxes imminent (with TRAIN Infographic #4)

September 19, 2017

Though welcome, the recent wage hike in the National Capital Region (NCR) does not increase the minimum wage earners’ purchasing power. The real value of the minimum wage is even falling while the people face higher taxes under government’s proposed tax reforms, said the group. The NCR Regional Wage Board recently announced a Php21 wage hike, […]

IBON: DOF insistence on its tax package confirms anti-poor, pro-rich Dutertenomics

September 15, 2017

Research group IBON said that the Department of Finance’s (DOF) resistance to even minor changes in its proposed tax reform program confirms the anti-poor and pro-rich character of the Duterte administration’s economic policies. The Senate Ways and Means Committee proposed minor changes to shift some tax burden from the poor to the rich at its […]

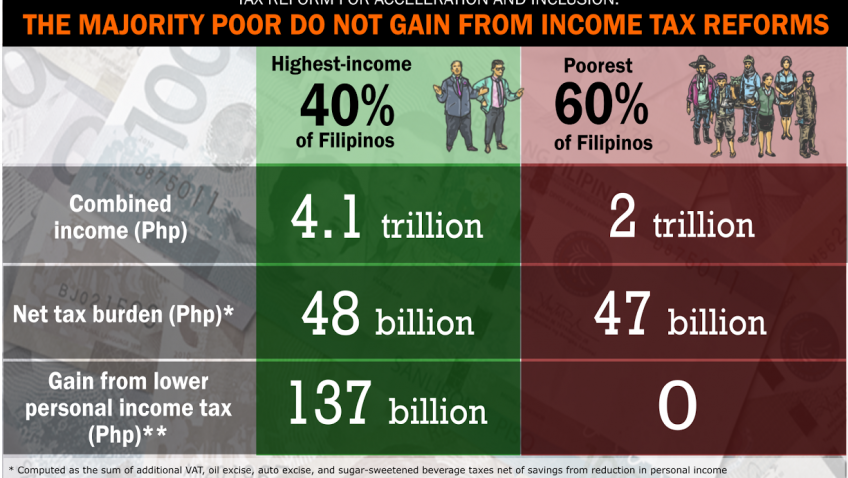

Under TRAIN, the majority poor do not gain from income tax reforms (TRAIN Infographic #3)

September 11, 2017

The DOF’s estimates of personal income tax gains for the poorest Filipinos erroneously assumes that the poorest Filipinos currently pay income tax. This is untrue because the BIR’s records indicate only some 5.6 million taxpayers at present who are wholly from the highest income brackets. The poorest Filipinos do not pay income tax now so, contrary […]

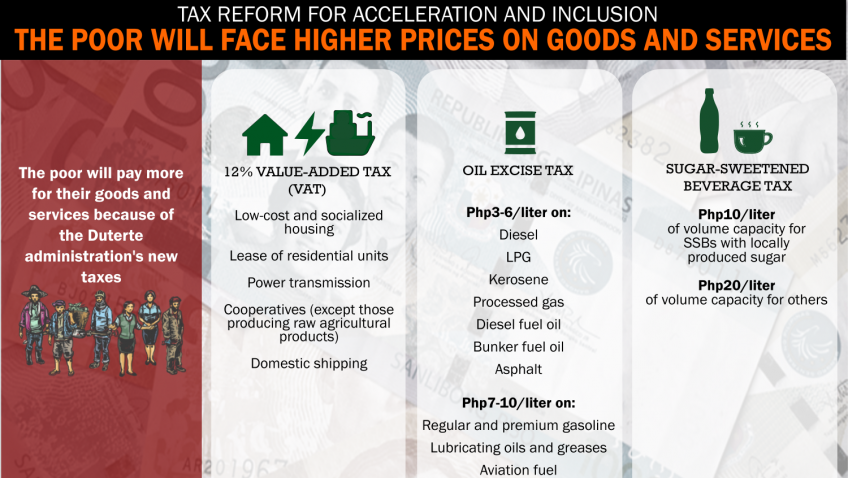

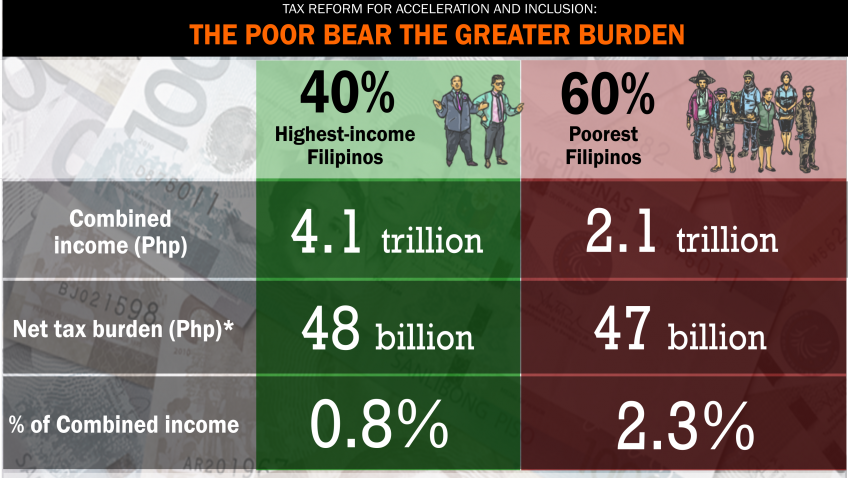

Under TRAIN, the poor bear the greater burden (TRAIN Infographic #2)

September 7, 2017

Under the tax ‘reform’ package which is currently being deliberated by the Philippine Senate, the poorest 60 million Filipinos will pay Php47.0 billion in additional taxes next year which is 2.3% of their combined family income of some Php2.0 trillion. The highest income 40%, meanwhile, will pay Php47.6 billion which is only 0.8% of their total family […]

DOF insistence on anti-poor tax package for free educ hit

August 31, 2017

Research group IBON said that the Department of Finance (DOF) should not use free education as a pretext for the Philippine Senate to pass a full version of the administration’s anti-poor tax reform package. The group also said that the administration should instead decisively tax the country’s wealthiest for national development needs. Finance secretary Carlos […]

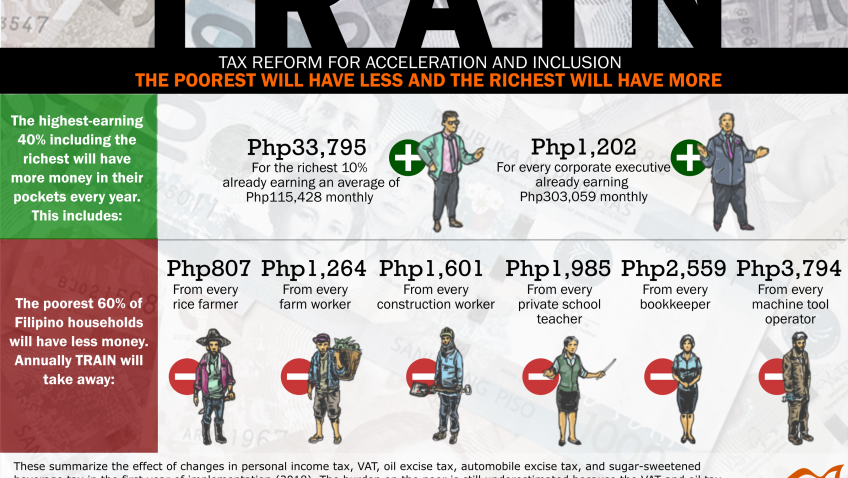

Under TRAIN, the poorest will have less and the richest will have more (TRAIN Infographic #1)

August 30, 2017

That the Duterte administration’s Tax Reform for Acceleration and Inclusion (TRAIN) is progressive and pro-poor is all hype. Under TRAIN the highest-earning 40% including the richest will have more money in their pockets every year, while the poorest 60% of Filipino households will have less money due to changes in personal income tax, VAT, oil excise […]

2nd quarter growth rates point to economic headwinds

August 22, 2017

Research group IBON said that the recently released 2017 second quarter national accounts underscore the serious headwinds facing the Philippine economy. The group said that the Duterte administration should focus on building sustainable domestic foundations of growth and development rather than depend on external factors such as remittances, cheap labor business process outsourcing (BPO), and […]