regressive taxation

TRAIN-driven rising cost of living makes wage hike urgent

July 9, 2018

Research group IBON said that tax-driven inflation is making the meager wages of poor Filipinos fall even further behind the rising cost of living. The group said this makes it even more urgent for the government to immediately raise wages even as it revisits the Tax Reform for Acceleration and Inclusion (TRAIN) law behind the […]

Duterte’s TRAIN a scourge, not a gift—IBON

December 21, 2017

Research group IBON said that contrary to its claims, the Duterte administration affirmed its apathy towards the low-income majority of Filipinos upon its signing of the Tax Reform for Acceleration and Inclusion (TRAIN). By signing the tax program into law, government has proven its determination to collect funds for its purportedly pro-poor centerpiece programs but […]

Will the poor benefit from paying higher taxes?

September 25, 2017

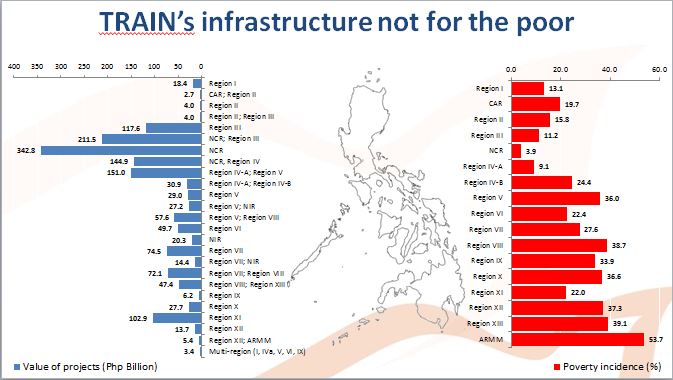

by Audrey de Jesus Among the hyped claims of the Department of Finance (DOF) about the government’s tax reform package is how taxes paid by the poor will go back to them in the form of infrastructure projects and social services. The reality however is that the taxes will go largely to big-ticket infrastructure projects […]

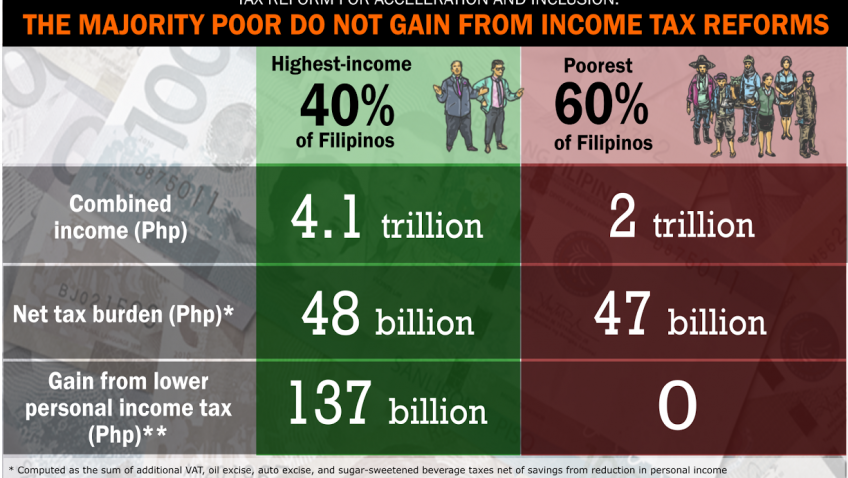

Under TRAIN, the majority poor do not gain from income tax reforms (TRAIN Infographic #3)

September 11, 2017

The DOF’s estimates of personal income tax gains for the poorest Filipinos erroneously assumes that the poorest Filipinos currently pay income tax. This is untrue because the BIR’s records indicate only some 5.6 million taxpayers at present who are wholly from the highest income brackets. The poorest Filipinos do not pay income tax now so, contrary […]

Tax ‘reform’ program burdens poor more than the rich–IBON

July 30, 2017

Research group IBON said that Pres. Rodrigo Duterte’s State of the Nation (SONA) statement that “we achieved the first step towards more equitable taxes” is incorrect because the poorest majority of Filipinos will be more burdened by taxes than the rich. The Department of Finance (DOF) is covering this up, the group also said. According […]

Buwis(et)! DOF’s Top 5 Tax Reform Lies

June 20, 2017

By Sonny Africa IBON FEATURES — The Tax Reform for Acceleration and Inclusion Act (TRAIN), the first part of the Duterte administration’s Comprehensive Tax Reform Program (CTRP), has hurdled the House of Representatives (HOR) and is up for deliberations at the Senate. The Department of Finance (DOF) targets approval of TRAIN, or House Bill No. […]

Tax reform should be pro-poor, progressive

June 3, 2017

Research institution IBON said that government should be willing to forge a genuinely progressive tax system instead of adopting one that remains pro-rich. The group said this upon recent Congressional approval of the first part of the Department of Finance’s (DOF) Comprehensive Tax Reform Package (CTRP). Forging a truly progressive tax package is an important […]

Fuel excise tax more burden than boon for poor — IBON

January 9, 2017

Research group IBON said that the fuel excise tax being pushed by President Duterte’s economic managers will increase taxes on already burdened poor and low income wage earners. The group said that the Duterte administration should redesign the tax system to tax the richest who have the huge ability to pay more and relieve […]

Tax the richest to provide much-needed social services, Duterte gov’t urged

September 27, 2016

Research group IBON remarked that the Department of Finance’s (DOF) proposed tax plan essentially remains elitist and is inconsistent with President Duterte’s pro-poor stance. Following the president’s lead, government should be brave enough to tax the richest businesses and families instead of burdening the poor with new taxes. The DOF on Monday submitted to Congress […]