TRAIN

Gov’t can mitigate oil price hikes by scrapping fuel taxes

August 8, 2023

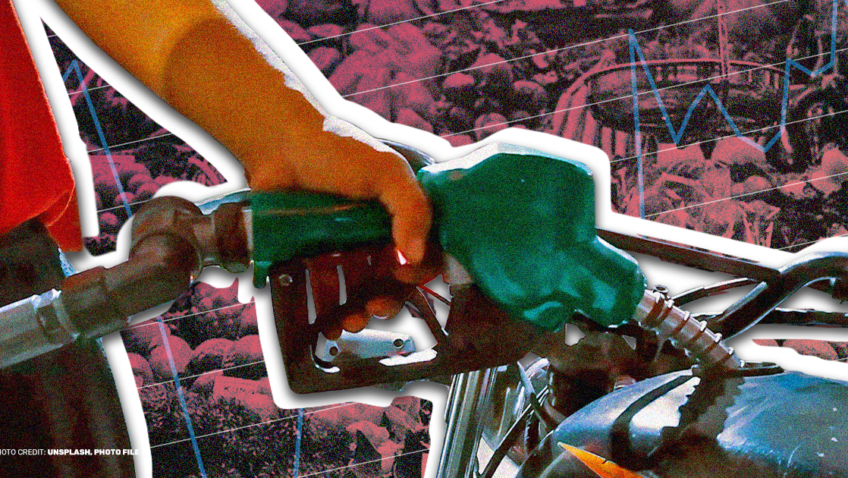

The Marcos Jr administration can moderate the impact of oil price hikes on millions of Filipinos by scrapping excise and value-added taxes for petroleum products.

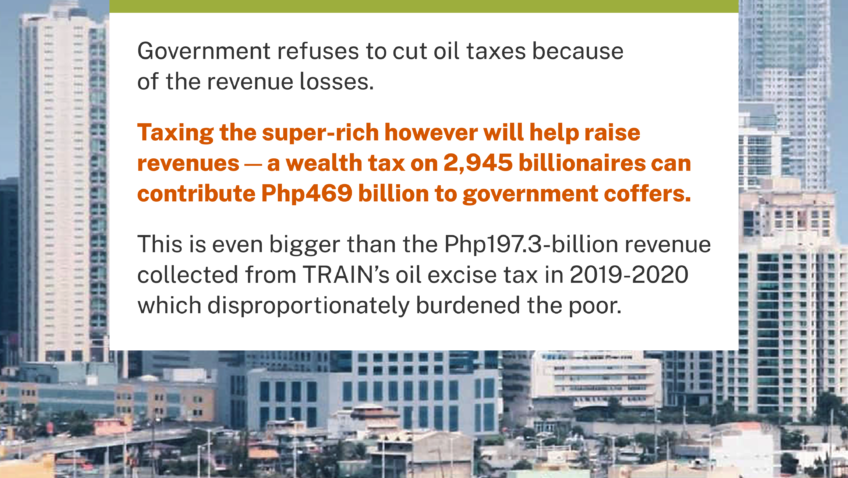

Tax billionaire wealth to raise revenues

October 11, 2022

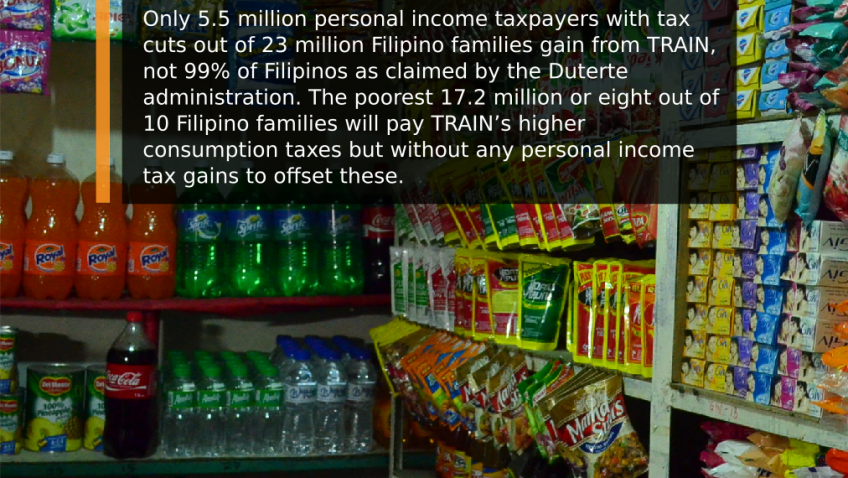

Government refuses to cut oil taxes because of revenue losses. Taxing the super-rich however will help raise revenues—a wealth tax on 2,945 billionaires can contribute Php469 billion to government coffers. This is even bigger than the Php197.3-billion revenue collected from TRAIN’s oil excise tax in 2019-2020 which disproportionately burdened the poor.

Suspending TRAIN oil taxes will lower oil prices and ease inflation—IBON

October 23, 2021

Suspending oil excise taxes, can ease the burden of rising prices on ordinary Filipinos, and revenue losses can be compensated by suspending corporate tax cuts. These can be the start of a more progressive tax system and a prelude to better regulation and control over the country’s oil industry.

Use ₱133.9-billion TRAIN revenues for ayuda – IBON

August 14, 2021

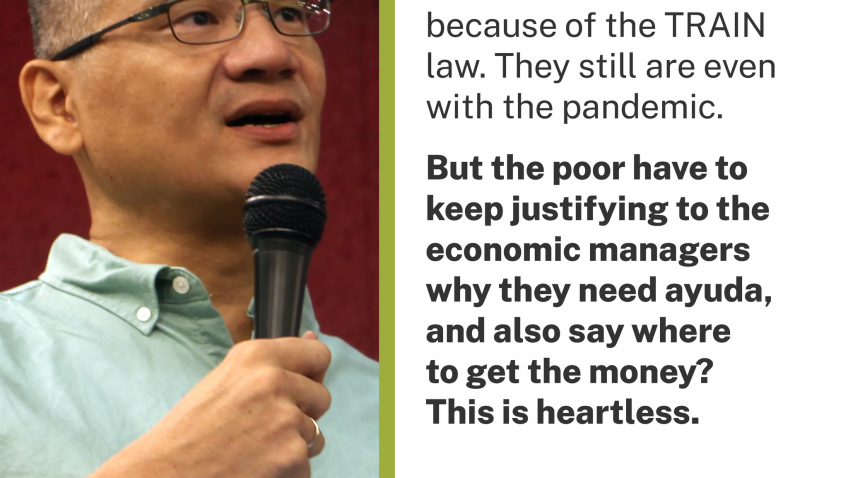

The Duterte administration can use revenue generated by its regressive TRAIN law to fund emergency cash assistance. TRAIN’s new taxes increased the prices for goods and services consumed by the majority poor Filipinos even amid the pandemic and the revenues can be used productively while the law remains.

IBON Executive Director on TRAIN and ayuda funds

July 31, 2021

IBON Executive Director on TRAIN and ayuda funds

Why make the poor pay for COVID-19 response?

May 24, 2020

COMMENTARY

There’s more than enough money for all the COVID-19 response we need – the Duterte administration just has to take the side of the people and stop being so scared of the rich.

The truth about TRAIN

July 10, 2019

#MalalangEkonomiya #MayMagagawa #PeopleEconomic #PeoplesSONA2019

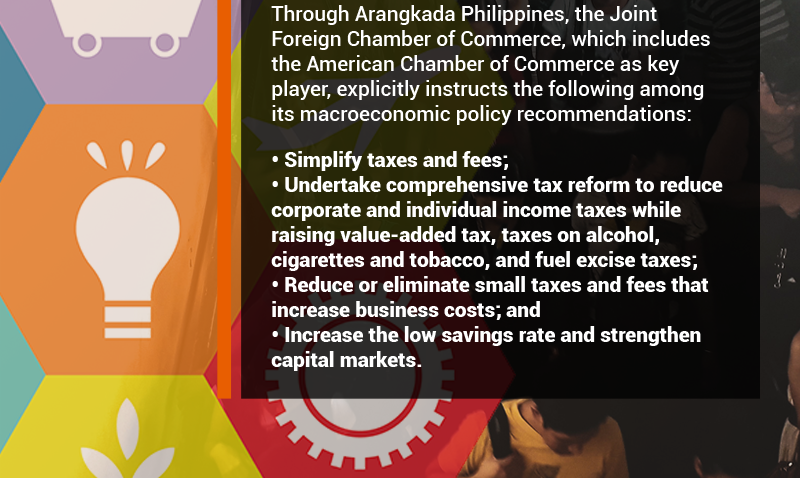

Regressive TRAIN Law A Foreign Dictate

June 13, 2019

On Sin Tax: Raise direct taxes rather than consumer taxes –IBON

June 7, 2019

Research group IBON said that the passing of the Sin Tax Reform Bill made the country’s tax system more regressive by increasing consumer taxes that burden the poor while cutting income tax and corporate tax that make the rich even richer. As part of the government’s tax reform agenda, Senate Bill No.2233 or the Sin […]