Tax Reforms

Double taxes on oil show govt’s lack of concern for poor – IBON

February 23, 2018

Slapping additional taxes on oil products makes the Tax Reform for Acceleration and Inclusion (TRAIN) law anti-poor, research group IBON said. Contrary to the argument that the new law is ‘fair’, the group said that these oil taxes should be scrapped for the benefit of millions of Filipinos who will otherwise continue to suffer the […]

Independent foreign policy? Foreign interests behind TRAIN, Cha-cha, says IBON

January 18, 2018

While President Duterte likes to claim that his administration adheres to an independent foreign policy, it appears that his major programs such as the packages of tax reforms and the planned Charter change (Cha-cha) are actually pushed by US and other foreign interests. IBON noted that the tax reforms and Cha-cha are among the key policy reforms long lobbied for by […]

Letter to the Editor | Five reasons why the TRAIN will not benefit the poor

January 16, 2018

These reiterations are in reaction to the article “Assessing TRAIN” by Mr. Filomeno Sta. Ana of the Action for Economic Reforms (AER), which appeared on the January 8, 2018 issue of Business World. IBON has repeatedly presented its evidence-based analysis of the TRAIN (basing on the Department of Finance data no less) and consistently deepened […]

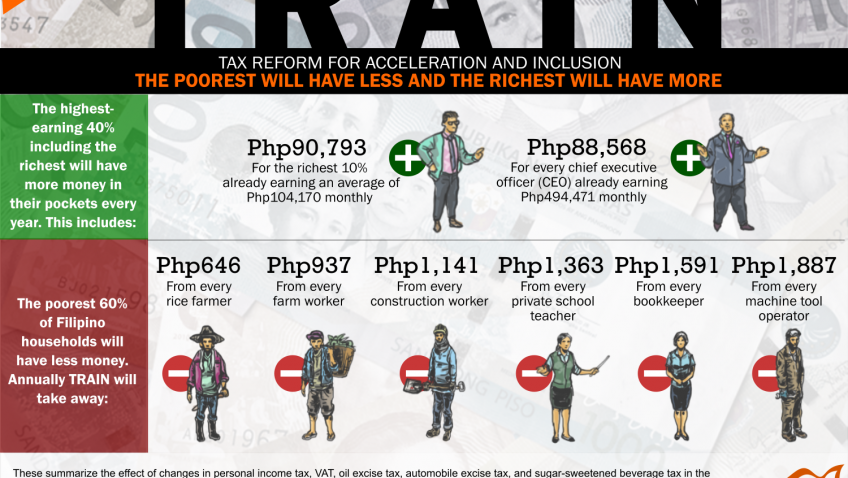

Under TRAIN,the poorest will have less and the richest will have more (update)

January 14, 2018

The rich and other higher income groups will have larger take home pay than previously estimated under the new tax law, while the poor will still bear the brunt of paying higher taxes. The highest earning 40% or about 9.1 million households will have even more money in their pockets under the recently passed Tax […]

Even more money for the rich under TRAIN law – IBON

January 12, 2018

The rich and other higher income groups will have larger take home pay than previously estimated under the new tax law, while the poor will still bear the brunt of paying higher taxes, said research group IBON. IBON said that the highest earning 40% or about 9.1 million households will have even more money in […]

Downplaying the price impact of TRAIN dishonest and insensitive–IBON

January 8, 2018

Petroleum excise taxes proven to be very inflationary in the past The administration persistently downplays certain increases in the prices of goods and services, research group IBON’s Executive Director Sonny Africa said. This is dishonest and insensitive to the burden that the Tax Reform for Acceleration and Inclusion (TRAIN) imposes on the poor to avoid […]

2018 prosperity by Duterte policies not for all—IBON

January 2, 2018

Admin’s avid push for market-driven measures will run over the poor majority The new year seems to usher in more difficulties for Filipinos in accessing basic goods, public utilities, and services amid government’s exclusionary policies, research group IBON said. The market-driven policies that have been prioritized by the Duterte government such as the Tax Reform […]

Duterte’s TRAIN a scourge, not a gift—IBON

December 21, 2017

Research group IBON said that contrary to its claims, the Duterte administration affirmed its apathy towards the low-income majority of Filipinos upon its signing of the Tax Reform for Acceleration and Inclusion (TRAIN). By signing the tax program into law, government has proven its determination to collect funds for its purportedly pro-poor centerpiece programs but […]

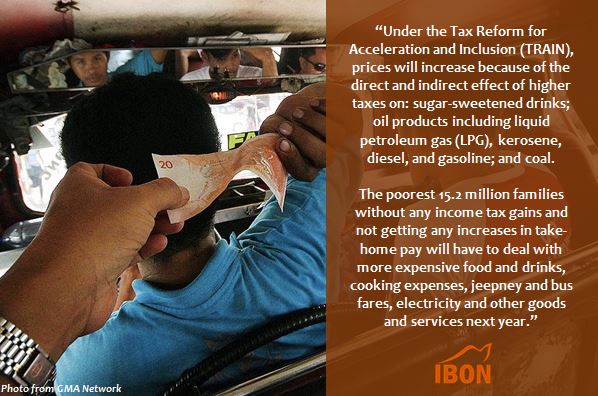

Prices will increase beyond the Christmas season

December 19, 2017

On the day that Pres Duterte signs the tax reform package, IBON underscores how TRAIN will entail price hikes on various goods and services beyond Christmas. IBON Foundation, Inc. is an independent development institution established in 1987 that provides research, education, publications, information work and advocacy support on socioeconomic issues. — Media & Communications Department […]