Tax Reforms

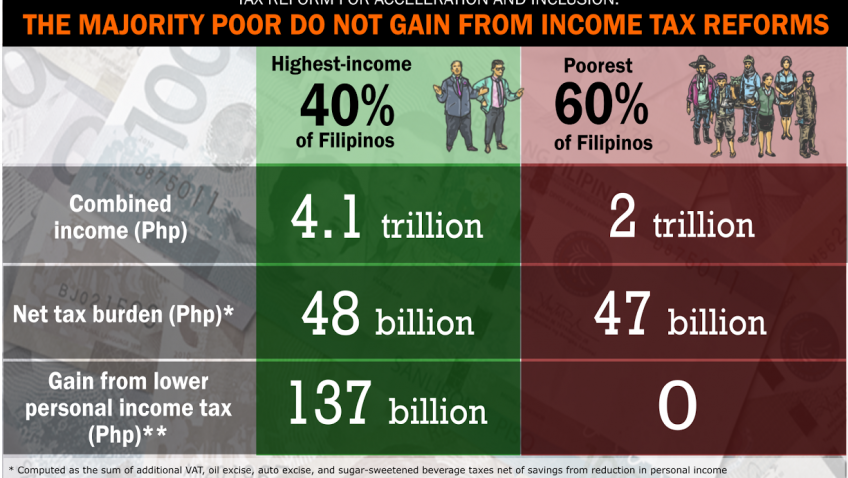

Under TRAIN, the majority poor do not gain from income tax reforms (TRAIN Infographic #3)

September 11, 2017

The DOF’s estimates of personal income tax gains for the poorest Filipinos erroneously assumes that the poorest Filipinos currently pay income tax. This is untrue because the BIR’s records indicate only some 5.6 million taxpayers at present who are wholly from the highest income brackets. The poorest Filipinos do not pay income tax now so, contrary […]

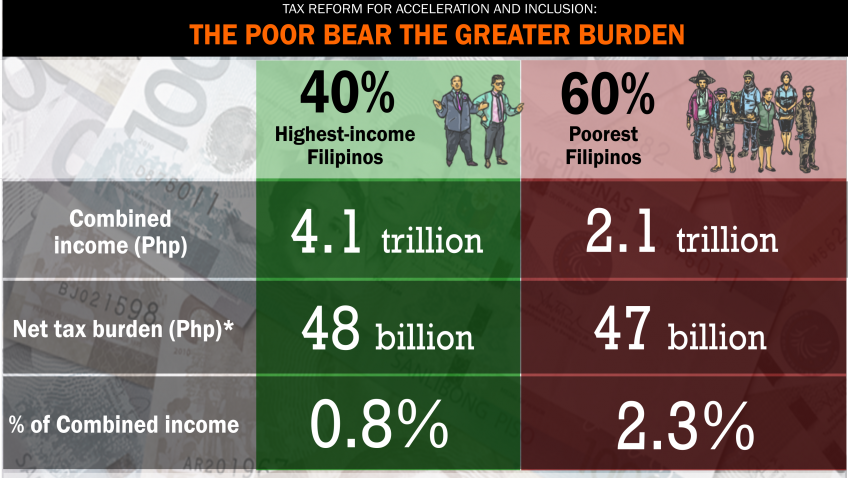

Under TRAIN, the poor bear the greater burden (TRAIN Infographic #2)

September 7, 2017

Under the tax ‘reform’ package which is currently being deliberated by the Philippine Senate, the poorest 60 million Filipinos will pay Php47.0 billion in additional taxes next year which is 2.3% of their combined family income of some Php2.0 trillion. The highest income 40%, meanwhile, will pay Php47.6 billion which is only 0.8% of their total family […]

DOF insistence on anti-poor tax package for free educ hit

August 31, 2017

Research group IBON said that the Department of Finance (DOF) should not use free education as a pretext for the Philippine Senate to pass a full version of the administration’s anti-poor tax reform package. The group also said that the administration should instead decisively tax the country’s wealthiest for national development needs. Finance secretary Carlos […]

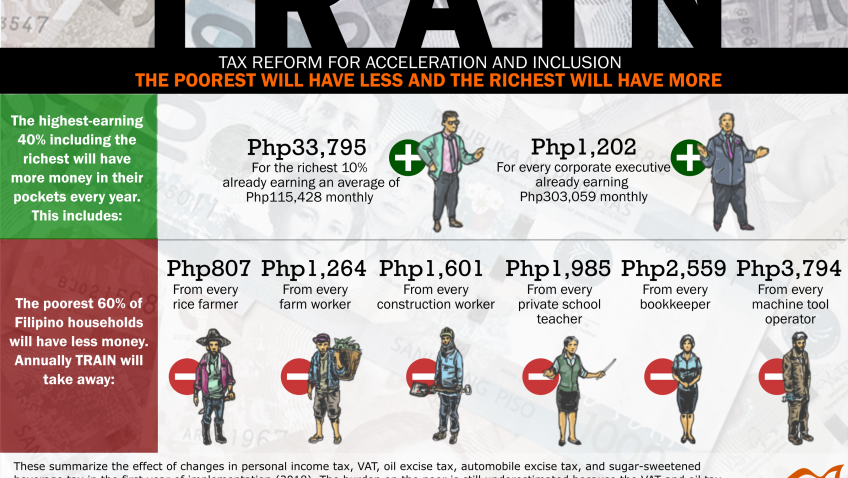

Under TRAIN, the poorest will have less and the richest will have more (TRAIN Infographic #1)

August 30, 2017

That the Duterte administration’s Tax Reform for Acceleration and Inclusion (TRAIN) is progressive and pro-poor is all hype. Under TRAIN the highest-earning 40% including the richest will have more money in their pockets every year, while the poorest 60% of Filipino households will have less money due to changes in personal income tax, VAT, oil excise […]

Tax ‘reform’ program burdens poor more than the rich–IBON

July 30, 2017

Research group IBON said that Pres. Rodrigo Duterte’s State of the Nation (SONA) statement that “we achieved the first step towards more equitable taxes” is incorrect because the poorest majority of Filipinos will be more burdened by taxes than the rich. The Department of Finance (DOF) is covering this up, the group also said. According […]

Buwis(et)! DOF’s Top 5 Tax Reform Lies

June 20, 2017

By Sonny Africa IBON FEATURES — The Tax Reform for Acceleration and Inclusion Act (TRAIN), the first part of the Duterte administration’s Comprehensive Tax Reform Program (CTRP), has hurdled the House of Representatives (HOR) and is up for deliberations at the Senate. The Department of Finance (DOF) targets approval of TRAIN, or House Bill No. […]

Tax reform should be pro-poor, progressive

June 3, 2017

Research institution IBON said that government should be willing to forge a genuinely progressive tax system instead of adopting one that remains pro-rich. The group said this upon recent Congressional approval of the first part of the Department of Finance’s (DOF) Comprehensive Tax Reform Package (CTRP). Forging a truly progressive tax package is an important […]

Pro-rich, anti-poor tax program passes through House committee –IBON

May 5, 2017

As the Tax Reform for Acceleration and Inclusion Act (TRAIN) which contains the first part of the Department of Finance’s (DOF) proposed Tax Reform Package advances in Congress, research group IBON reiterated that this legislative proposal remains biased for the rich and burdens the poor. With the majority approval of the House of Representatives committee […]

Lower taxes for the poor/ Economic reforms the most compelling reason to continue the peace talks

February 5, 2017

Pres. Rodrigo Duterte recalled the government’s peace negotiators from negotiations with the National Democratic Front of the Philippines (NDFP) until being given “compelling reason” to resume talks. Research group IBON, however, points out that the most compelling reason for having peace talks are the economic and political reforms on the agenda that can address the roots […]