VAT

Despite rollbacks, TRAIN makes fuel more expensive–IBON

December 4, 2018

Research group IBON said that even with recent oil price rollbacks, the Duterte administration’s Tax Reform for Acceleration and Inclusion law (TRAIN) increases fuel prices with an inflationary effect burdening the poor more than the rich. IBON pointed out that rollbacks have always been proven to be temporary and stressed that TRAIN’s taxes make fuel […]

TRAIN-driven rising cost of living makes wage hike urgent

July 9, 2018

Research group IBON said that tax-driven inflation is making the meager wages of poor Filipinos fall even further behind the rising cost of living. The group said this makes it even more urgent for the government to immediately raise wages even as it revisits the Tax Reform for Acceleration and Inclusion (TRAIN) law behind the […]

Hindi Totoong Maka-mahirap Ang TRAIN Ni Duterte

October 11, 2017

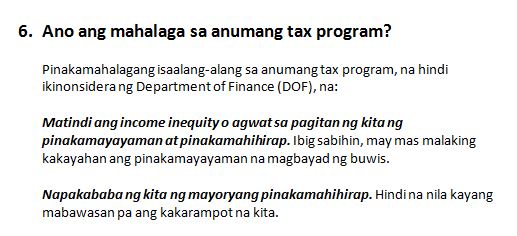

Ano ang TRAIN? Itinuturing na ‘urgent’ ng gubyernong Duterte ang Tax Reform for Acceleration and Inclusion o TRAIN. Layunin ng TRAIN na makalikom ng P1.3 trillion para tustusan ang Build! Build! Build! o ang engrandeng programa sa imprastruktura ng pamahalaan. Itutulak daw nito ang pambansang pag-unlad at ang kapakanan ng mahihirap. Sa ilalim ng […]

Real wage falling, higher taxes imminent (with TRAIN Infographic #4)

September 19, 2017

Though welcome, the recent wage hike in the National Capital Region (NCR) does not increase the minimum wage earners’ purchasing power. The real value of the minimum wage is even falling while the people face higher taxes under government’s proposed tax reforms, said the group. The NCR Regional Wage Board recently announced a Php21 wage hike, […]

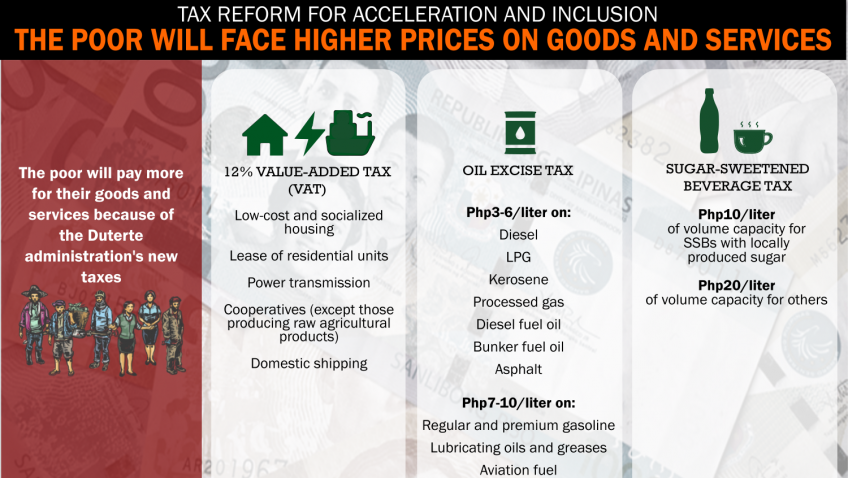

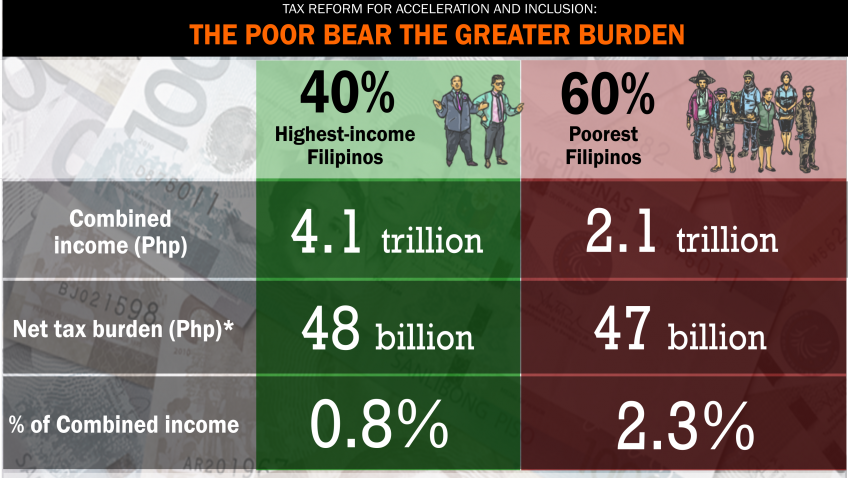

Under TRAIN, the poor bear the greater burden (TRAIN Infographic #2)

September 7, 2017

Under the tax ‘reform’ package which is currently being deliberated by the Philippine Senate, the poorest 60 million Filipinos will pay Php47.0 billion in additional taxes next year which is 2.3% of their combined family income of some Php2.0 trillion. The highest income 40%, meanwhile, will pay Php47.6 billion which is only 0.8% of their total family […]

DOF insistence on anti-poor tax package for free educ hit

August 31, 2017

Research group IBON said that the Department of Finance (DOF) should not use free education as a pretext for the Philippine Senate to pass a full version of the administration’s anti-poor tax reform package. The group also said that the administration should instead decisively tax the country’s wealthiest for national development needs. Finance secretary Carlos […]

Tax the richest to provide much-needed social services, Duterte gov’t urged

September 27, 2016

Research group IBON remarked that the Department of Finance’s (DOF) proposed tax plan essentially remains elitist and is inconsistent with President Duterte’s pro-poor stance. Following the president’s lead, government should be brave enough to tax the richest businesses and families instead of burdening the poor with new taxes. The DOF on Monday submitted to Congress […]

World Bank tax help unwelcome

September 20, 2016

Research group IBON said that the World Bank’s recent offer to assist the Department of Finance (DOF) with its tax reform plan, although not surprising, is unwelcome news. The World Bank with twin global financial pillar International Monetary Fund (IMF) has long been at the forefront of designing the Philippines’ regressive tax system, including providing […]

TAX GANERN! DOF’s Tax Reforms Tax the Poor and Relieve the Rich (Part 1)

September 2, 2016

by Sonny Africa (First of Two Parts) The Department of Finance (DOF) will submit a tax policy reform program to Congress in September. The administration’s economic managers are using Pres. Rodrigo Duterte’s current popularity to push an unpopular pro-rich neoliberal tax agenda. The proposed program lowers the tax burden on the rich and on big […]