Gov’t should spare consumers from water firms’ Php82-B back charges

October 3, 2017

As the Philippine government launches Consumer Welfare Month, the Water for the People Network (WPN) warned against impending unreasonable water rates should government yield to the monetary demands of Maynilad Water Services Inc. and Manila Water Company. The network said that the Supreme Court decision that public utilities cannot pass on their corporate income taxes […]

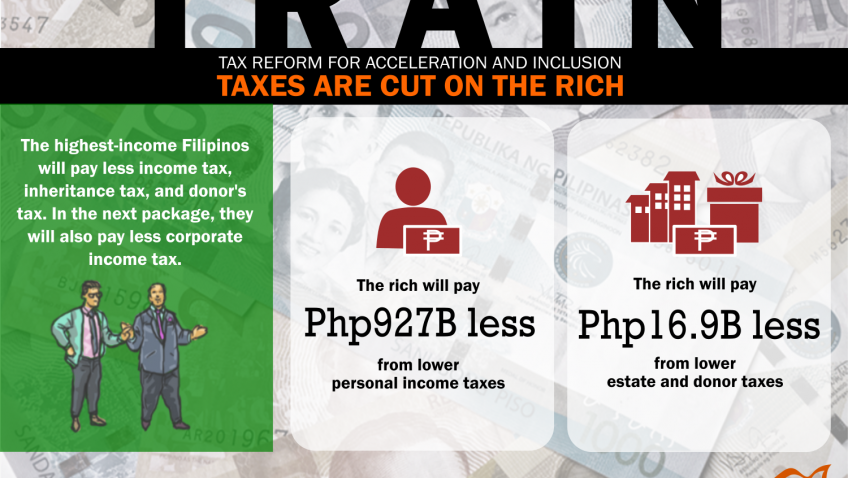

Under TRAIN, taxes are cut on the rich (TRAIN Infographic #5)

September 28, 2017

TRAIN will make the rich richer – The net impact of the change in income taxes, expansion of VAT coverage, new oil excise taxes, and inflationary effect is that the highest-earning 40% of Filipino households, or 9.1 million households with some 40 million Filipinos, will have more money in their pockets after the tax reform. This […]

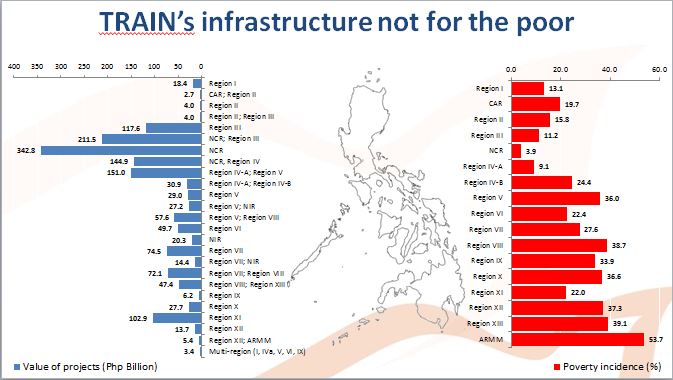

Will the poor benefit from paying higher taxes?

September 25, 2017

by Audrey de Jesus Among the hyped claims of the Department of Finance (DOF) about the government’s tax reform package is how taxes paid by the poor will go back to them in the form of infrastructure projects and social services. The reality however is that the taxes will go largely to big-ticket infrastructure projects […]

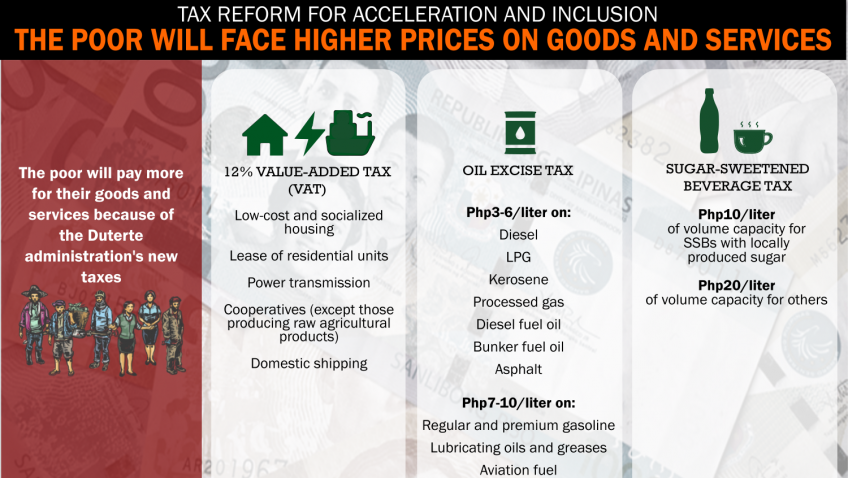

Real wage falling, higher taxes imminent (with TRAIN Infographic #4)

September 19, 2017

Though welcome, the recent wage hike in the National Capital Region (NCR) does not increase the minimum wage earners’ purchasing power. The real value of the minimum wage is even falling while the people face higher taxes under government’s proposed tax reforms, said the group. The NCR Regional Wage Board recently announced a Php21 wage hike, […]

IBON: DOF insistence on its tax package confirms anti-poor, pro-rich Dutertenomics

September 15, 2017

Research group IBON said that the Department of Finance’s (DOF) resistance to even minor changes in its proposed tax reform program confirms the anti-poor and pro-rich character of the Duterte administration’s economic policies. The Senate Ways and Means Committee proposed minor changes to shift some tax burden from the poor to the rich at its […]

Majority not in favor of tax reform proposals – IBON Survey

September 13, 2017

The latest survey of research group IBON showed that majority of Filipinos do not approve of almost all proposals under the first package of the Duterte administration’s proposed tax reform program. Survey respondents were informed that the government has a proposed tax reform package. They were presented with a list of some of the tax […]

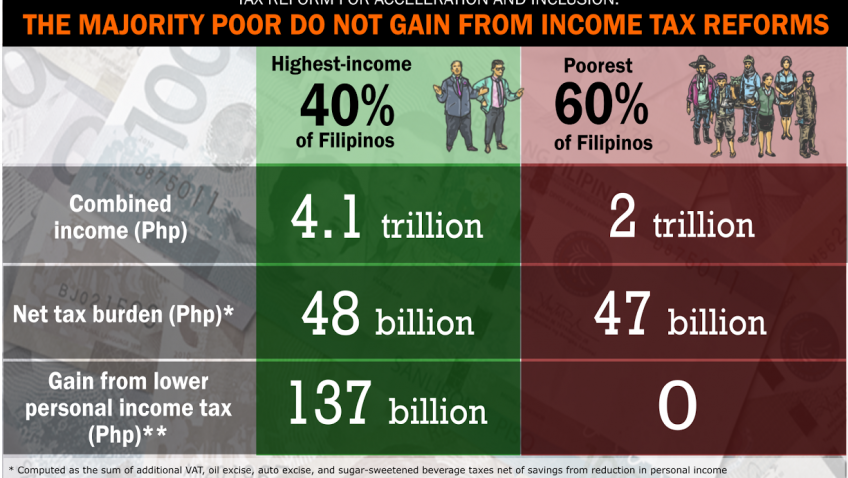

Under TRAIN, the majority poor do not gain from income tax reforms (TRAIN Infographic #3)

September 11, 2017

The DOF’s estimates of personal income tax gains for the poorest Filipinos erroneously assumes that the poorest Filipinos currently pay income tax. This is untrue because the BIR’s records indicate only some 5.6 million taxpayers at present who are wholly from the highest income brackets. The poorest Filipinos do not pay income tax now so, contrary […]

COMP attempting to greenwash dirty mining practices — IBON

September 7, 2017

Research group IBON said that the plan of the Chamber of Mines of the Philippines (COMP) to adopt a Canadian mining organization’s sustainable mining measures indicates that it is trying to greenwash the Philippine mining industry’s negative image. But Canadian mining corporations are notorious for their dirty operations globally, IBON pointed out, which have led […]

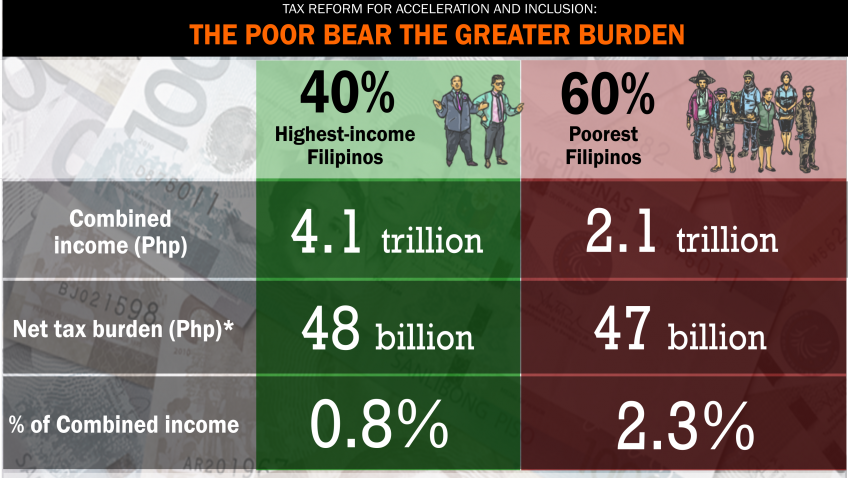

Under TRAIN, the poor bear the greater burden (TRAIN Infographic #2)

September 7, 2017

Under the tax ‘reform’ package which is currently being deliberated by the Philippine Senate, the poorest 60 million Filipinos will pay Php47.0 billion in additional taxes next year which is 2.3% of their combined family income of some Php2.0 trillion. The highest income 40%, meanwhile, will pay Php47.6 billion which is only 0.8% of their total family […]